Bitcoin self-custody is the act of individuals directly holding their own bitcoin without the use of custodial wallets or intermediaries such as exchanges or other third-party services. This enables you to have complete control and responsibility over your bitcoin by securely storing in a self-custodial wallet using your own private keys or seed phrase.

When you keep your bitcoin in a custodial wallet or a wallet owned by an exchange, such as Coinbase or Binance, you don’t have full control over your funds. If the wallet shuts down or the exchange goes bankrupt or block access to your funds, there is nothing you can do because they hold the private keys to your wallet.

For the safety of your funds, we urge you to only keep the amount you plan to trade on a Bitcoin exchange. Any excess earnings should be stored in a self-custody wallet, like the ones listed below, to ensure maximum security. See the list of failed Bitcoin exchanges whose users lost their funds.

Not Your Keys, Not Your Coins

The phrase “not your key, not your coins” is widely used in the bitcoin community to emphasize the importance of self-custody bitcoin management. The phrase means that you do not have full control and ownership of your bitcoin if you do not have the private key to it. In other words, if someone else has your private key, they can access and control your Bitcoin without your knowledge or permission.

Benefits of Self Custody

Individuals who have self-custody can enjoy several benefits from having more control over their bitcoin.

One of the most significant advantages of self-custody is ownership and control. Individuals who hold their bitcoin in self-custodial accounts can access and manage their assets without relying on intermediaries. They have complete control over their money and can conduct transactions, check their balance, and manage them as they see fit.

Another important advantage of self-custody is privacy. Individuals who use self-custody do not have to share their financial information with third parties, which allows them to keep their financial information private. This is especially important for people who value their privacy or live in authoritarian regimes where their financial information must be kept private.

Security is also a significant advantage of self-custody. Individuals can reduce the risk of bitcoin theft or hacking by keeping funds in their own wallets. Furthermore, self-custody can provide security if an exchange collapses. They can keep their bitcoin safe and secure, and they don’t have to worry about intermediaries such as bitcoin exchanges mismanaging or losing their bitcoin.

Furthermore, self-custody allows people to avoid censorship. Individuals can avoid censorship or restrictions imposed by governments or other intermediaries by transacting and holding bitcoin in a decentralized manner. They can transact freely without fear of having their bitcoin seized or frozen.

Another advantage of self-custody is the ability to save money. Individuals can save money on fees and other costs associated with exchanges. They can save money and keep more of their bitcoin while not having to pay high fees to third-parties.

Finally, self-custody is more convenient. Individuals can access their bitcoin from anywhere, at any time, using their self-custody wallets. This gives them more flexibility and convenience, and they can manage their funds whenever they want without relying on third-parties.

List of Self-Custody Wallets

Based on their security and accessibility features, self custody wallets can be divided into two categories: hot wallets and cold wallets. A hot wallet refers to a bitcoin wallet that is connected to the internet, while a cold wallet refers to a wallet that is not connected to the internet and is stored offline.

There are various types of hot and cold wallets that can be used for self-custody. Self-custody wallets examples include the following:

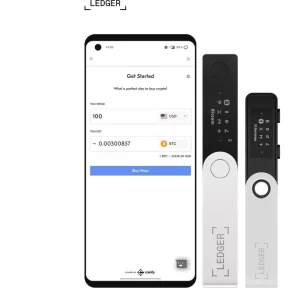

- Hardware wallets, also known as cold wallets, are self custodial hardware wallets. They are physical devices designed to store bitcoin securely. Because they are offline and not connected to the internet, they are regarded as one of the safest forms of self-custody. Examples of hardware wallets include Trezor, Passport, Coldcard, and Ledger.

- Software wallets, also known as hot wallets, are digital wallets that can be downloaded and installed on a computer or mobile device. They provide a convenient and accessible way to store and manage bitcoin, but because they are connected to the internet, they can be less secure than hardware wallets. Examples of mobile wallets include BlueWallet, Muun, Mycelium, and Samourai. Additionally, notable desktop wallets encompass Wasabi, Exodus, and Electrum.

- Paper wallets are physical wallets that are printed with a bitcoin’s private key and public address. They offer a safe and secure form of self-custody, but they can be difficult to use and manage.

- Multi-sig wallets require multiple signatures or approvals before a transaction can be completed. They add another layer of security and are typically used by organizations or groups of people. Examples of multi-sig wallets include BlueWallet, Passport, and Blockstream Jade.

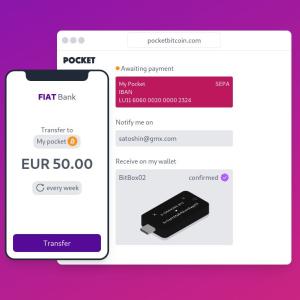

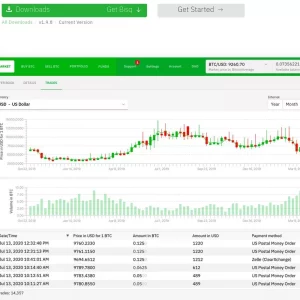

- Self-custody can also be achieved when buying or selling bitcoin through decentralized exchanges (DEXs). Decentralized exchanges (DEXs) such as Bisq, Pocket Bitcoin, Bringin, Relai, Beaver Bitcoin, and StackinSat are exchanges that allow individuals to trade bitcoin directly without the use of custodial wallets owned by the exchange. They offer a decentralized form of self-custody and are potentially more secure and private than centralized exchanges.

- Some centralized exchanges enable users to maintain control of their Bitcoin in their own wallets. They achieve this by either not providing custodial wallets on their platforms or implementing an auto-withdraw feature to users’ personal wallets. An example of a noncustodial centralized exchange is Bull Bitcoin, Pocket Bitcoin, Bittr, and Bitaroo.

In conclusion, when it comes to bitcoin management, Bitcoin self custody generally provides people with more control, privacy, security, freedom from censorship, cost savings, and convenience.

For the safety of your funds, we urge you to only keep the amount you plan to trade on a Bitcoin exchange. Any excess earnings should be stored in a self-custody wallet, like the ones listed below, to ensure maximum security. See the list of failed Bitcoin exchanges whose users lost their funds.