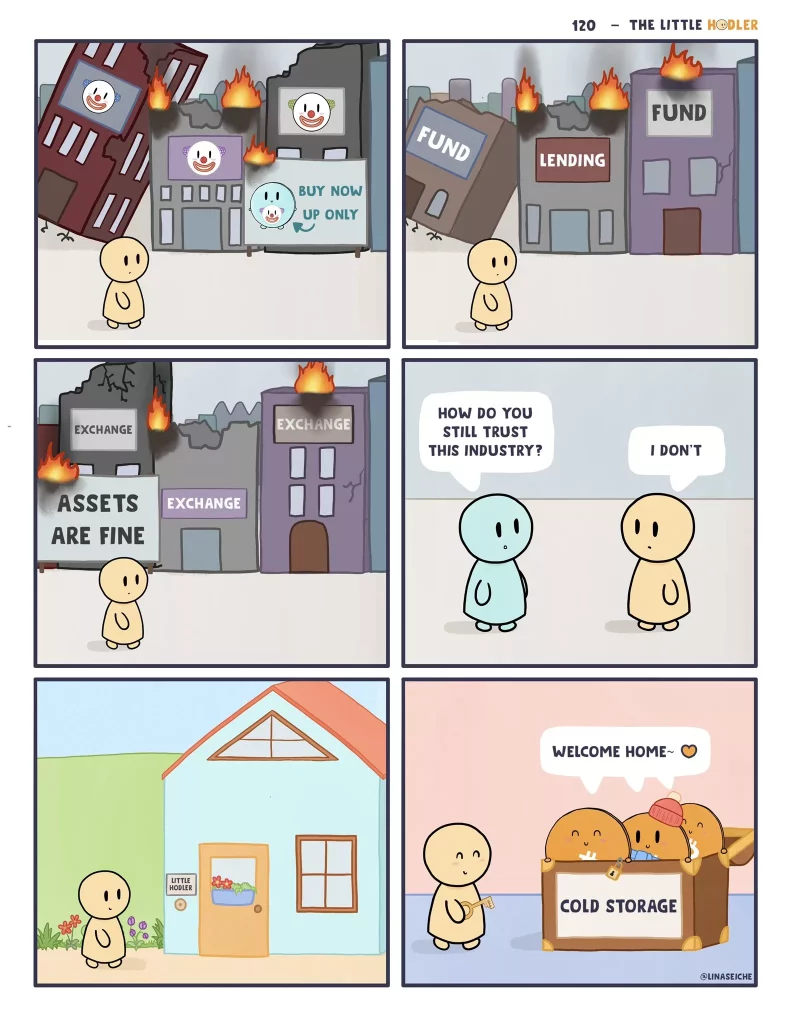

The list of failed cRyPtO exchanges and other platforms, such as Initial Coin Offerings (ICOs), that disappeared with user funds is long and continues to rise. This serves as a stark warning. While legitimate exchanges exist, especially Bitcoin-only, non-custodial exchanges, the industry remains vulnerable to fraudsters and “casino capitalists”. These include those running pump-and-dump schemes, exit scams, and peddling get-rich-quick schemes that prey on speculators.

This is the reason keeping your bitcoin on an exchange is not recommended at all. Instead, consider practicing bitcoin self-custody with software wallets or hardware wallets.

Bitcoin traders: Custodial Bitcoin exchanges are NOT your bank. A single security breach or exchange failure could mean losing everything. Only invest what you can afford to lose, and never store long-term holdings or profits on an exchange. Use a secure, self-custody wallet for maximum control and minimize risk.

Why Crypto Exchanges Fail

Several key factors contribute to crypto exchange failures, with some of the most prominent being:

- Lack of transparency: Many failed exchanges have lacked transparency in their financial practices, hiding losses, misusing funds, or inflating valuations. This erodes trust and contributes to panic withdrawals.

- Liquidity issues: Exchanges rely on sufficient user funds to facilitate trading. Poor risk management, overleveraging, and market downturns can lead to liquidity gaps, causing withdrawals to be suspended and ultimately insolvency.

- Fraudulent activity: Some failures are outright scams, with founders embezzling funds or manipulating markets for personal gain.

- Hacking and theft: Crypto exchanges are prime targets for hackers, who exploit security weaknesses to steal user funds. Weak cybersecurity practices significantly increase this risk.

- Evolving regulations: The crypto space is still grappling with unclear and evolving regulations. Non-compliance with existing regulations or failure to adapt to new ones can lead to fines, legal troubles, and even shutdowns.

- Contagion effects: The failure of a major player like FTX can trigger a domino effect, causing panic withdrawals and liquidity issues in other exchanges.

Centralized exchanges are like public toilets. Enter, do your business, then exit. – Anonymous

What Are the Safest Crypto Exchanges?

Generally, non-custodial and decentralized exchanges (DEXs) are often considered safer options. Unlike traditional, centralized exchanges that hold your funds (custodial wallets), non-custodial exchanges, such as Hodl Hodl (global), Peach Bitcoin (global), Relai (Europe), and Bull Bitcoin (Canada), eliminate that risk. They allow you to buy or sell Bitcoin through a self-custody wallet, giving you complete control.

Decentralized exchanges take this a step further by facilitating peer-to-peer trading without a central authority. This removes a single point of failure, making them more resilient to exchange shutdowns or failure. However, the trade-off is that decentralized exchanges can be less user-friendly for beginners.

How Many Crypto Exchanges Have Failed?

Pinpointing an exact number of defunct crypto exchanges is difficult due to the evolving nature of the market and the ambiguous closure reasons of some platforms. While a precise number is elusive, it’s safe to say that the number of crypto exchanges that have failed is substantial. However, based on available data and reports, several key observations emerge.

Reports suggest a considerable number of crypto exchanges have failed over the years, indicating the fragility of the sector. Estimates regarding the exact number of failed exchanges vary depending on the source and methodology used. Most research indicates that approximately 42% of these failed exchanges disappeared without explanation,. Additionally, roughly 9% of failed exchanges were found to be outright scams from their inception. These statistics underscore the importance of due diligence and caution when engaging with cryptocurrency exchanges

Based on our research, here’s a list of crypto exchanges that have failed to date. However, it’s important to note that this list is not be exhaustive due to the dynamic and rapidly changing nature of the cryptocurrency market.

List of Failed Crypto Exchanges in 2024

BitForex

Hong Kong-based cryptocurrency exchange BitForex experienced a significant disruption in February 2024, resulting in its website and trading app going offline. BitForex hasn’t officially announced a complete shutdown, and while the exchange is currently inaccessible, there haven’t been any official statements confirming a permanent closure. The disruption followed reports of a substantial withdrawal of around $57 million from BitForex’s wallets. Users are concerned that this disruption might be a rug pull, a scenario where the operators of a cryptocurrency project suddenly disappear with investors’ funds.

Hong Kong recently halted new license applications from crypto exchanges and requires existing unlicensed platforms to close by May 31, 2024, further adding to the uncertainty surrounding BitForex’s fate. While the exact reason for BitForex’s shutdown remains unclear, the large withdrawal and regulatory concerns raise questions about the exchange’s solvency and compliance. It’s important to note that the situation is still developing, and there may be further information revealed in the coming days.

List of Failed Crypto Exchanges in 2023

Bitrex

Bittrex, Inc. filed for bankruptcy in May 2023, following an accusation by the U.S. Securities and Exchange Commission (SEC) that it was operating as an unregistered securities exchange. This led to the ceasing of its operations in the United States on April 30, 2023. The exchange had had 600,000 active users in the U.S. Bittrex Global, which serves about 1.5 million active users outside the United States, suspended trading activities on December 4 in order to completely shut down.

Bizlato

The cryptocurrency exchange Bitzlato ceased operations in 2023. This followed a guilty plea by its former CEO, Anatoly Legkodymov, for running an unlicensed money services business. As part of the plea deal, Legkodymov agreed to shut down the exchange and forfeit $23 million in cryptocurrency.

The Rock Trading

The Rock Trading, was a Malta-based, Italian-run cryptocurrency trading company that was founded in 2011. The exchange halted operations due to liquidity problems in February 2023. Following a court-ordered liquidation process all customer money was frozen. The platform had a major weakness: all the money, both theirs and their users’, was kept in one bank account. This meant the directors had complete control over all the funds.

BKEX

On May 29, 2023, cryptocurrency exchange BKEX suspended operations and halted withdrawals due to allegations of money laundering involving user funds. BKEX claimed to be cooperating with law enforcement in their investigation and cited this cooperation as the reason for suspending withdrawals. The BKEX website is no longer accessible.

Patricia

Since May 2023, Nigerian cryptocurrency exchange Patricia has faced significant challenges. Users reported withdrawal issues starting in April, persisting for months. Although Patricia claimed a security incident in May didn’t affect user funds, users found their holdings converted to its token, PTK, without consent, with no clear way to withdraw them. Patricia’s controversial solution offers converting debts into company shares, but the terms and future value are unclear.

Genesis

Genesis Global Trading’s downfall came swiftly with its filing for Chapter 11 bankruptcy protection in January 2023. This collapse was triggered by a combination of factors: the broader cryptocurrency market crash of 2022, exposure to the fallout from the FTX exchange implosion, and allegations of poor risk management practices.

List of Failed Crypto Exchanges in 2022

FTX

FTX was one of the biggest exchanges in 2022. It was bringing cryptocurrency into the mainstream, spending millions on a Super Bowl commercial comparing cryptocurrency to the inventions of the wheel and the lightbulb, urging customers not to “miss out” on “the next big thing”. All of this while promoting FTX as “a safe and easy way to get into crypto.”

FTX didn’t safely deposit the money from their customers. It had lent US$10 billion in customer deposits to Alameda Research, a subsidiary of FTX, which had invested the funds riskily. Following the announcement of FTX’s bankruptcy, over a billion US dollars in customer deposits vanished due to suspicious transactions.

Blockfi

BlockFi was about to be purchased by FTX for up to $240 million. But following FTX’s declaration of bankruptcy in November 2022, Blockfi stopped customers making withdrawals on its platform. Blockfi is a digital asset lender that was established in 2017. Its headquarters are in Jersey City, New Jersey.

Liquid Global

Liquid Global suffered a major setback in November 2022. This was due to the collapse of FTX, the crypto exchange that had acquired Liquid Global earlier that year. FTX’s bankruptcy caused a ripple effect throughout the crypto industry, and Liquid Global, being owned by FTX, was impacted heavily. They have halted deposits, trading, and withdrawals on their platform due to the ongoing situation with FTX.

CoinFLEX

CoinFLEX was an exchange founded in 2019 that offered spot and margin trading, futures contracts, and its own interest-bearing stablecoins. However, CoinFLEX faced financial difficulties in 2022 and had to restrict withdrawals in June. In late 2023, creditors sued CoinFLEX’s CEO and the exchange announced it would cease operations by the end of October 2023.

Celcius

Celsius Network was a cryptocurrency lending company. Customers could deposit Bitcoin and Ethereum into a Celsius wallet to earn a percentage yield. Celcius promised yield percentages up to 10%. Customers could also borrow money by using their bitcoin as collateral. The company had lent $8 billion to clients and managed nearly $12 billion in assets when it went bankrupt. It is unknown how much of the borrowed money can actually be given back to the customers.

How many more are we going to see this year?

More exchanges are possibly to follow this year, such as Crypto.com. A big movement is taking shape of people withdrawing their funds into cold storage.

List of Failed Crypto Exchanges in 2021

Todex

Todex was a Turkish cryptocurrency exchange that went offline, and its CEO missing, in 2021. It left thousands of investors concerned that their funds have been stolen. In fact, it was revealed that the crimes committed caused $356 million TL in damages.

Einstein

In 2017, Einstein Exchange was established in Canada, and two years later they only had $34K USD in assets out of the $12 million USD they owed investors. Einstein had risen dramatically by mid-2019, but investors had difficulty accessing their funds during the summer and fall. Einstein announced their closure in October 2019.

List of Failed Crypto Exchanges in 2020

Cobinhood

Cobinhood, a cryptocurrency exchange known for zero-fee trading, shut down in 2020 following widespread rumors of bankruptcy. These rumors gained traction in May 2019, with news sources reporting on Cobinhood’s potential insolvency alongside its sister company, DEXON. Some reports suggested leaks of insider information, while others pointed to DEXON dumping its crypto tokens shortly after their ICO concluded – a move often associated with fraudulent fundraising schemes. Many observers suspected Cobinhood of orchestrating an exit scam, permanently disappearing with user funds.

List of Failed Crypto Exchanges in 2019

QuadrigaCX

Quadriga operated one of Canada’s biggest online cryptocurrency exchanges in 2018. But after the sudden death of the founder, cryptocurrencies worth of $190m USD was missing. The money was never found, the exchange went bankrupt, and the judge concluded it was a Ponzi scheme. Investigations after the fact revealed severe mismanagement practices and illegal financial activity as well as essentially no financial bookkeeping.

Cryptopia

After a January 2019 hack in which 15% of client funds were stolen, Cryptopia filed for bankruptcy and went into liquidation in May 2019. Cryptopia was based in New Zealand. Cryptopia was founded in 2014 by Rob Dawson and Adam Clark.

Bitgrail

In February 2018, the Italian cryptocurrency exchange BitGrail Srl revealed that fraudulent transactions had resulted in the theft of Nano tokens worth $170 million USD. Francesco Firano, the exchange’s founder, did great harm by delaying the disclosure of the loss and attempting to restart the exchange rather than handing over asset management to a trustee. This resulted that, in January 2019, an Italian court ordered that both Bitgrail and Firano Bank Inc. be declared bankrupt, and it compensated investors in the $170 million scheme.

List of Failed Crypto Exchanges in 2017

Youbit

On December 19, 2017, the owner of South Korean exchange Youbit filed for bankruptcy after suffering two attacks that year. Users were still granted access to 75% of their assets.

BTC-e

BTC-e, once a major player in the early cryptocurrency exchange scene founded in 2011, is no longer operational. Its story ended in a dramatic shutdown in 2017 after the US government seized its website and funds. Accusations of facilitating illegal activities, including processing billions from the infamous Mt. Gox hack, led to its downfall.

2016

Cryptsy was a shitcoin casino that disappeared at some point.

List of Failed Crypto Exchanges in 2014

MtGox

“Mt. Gox” was a bitcoin exchange based in Tokyo, Japan. It was launched in 2010 and handled up to 70% of all transactions around the world when it was in operation. As of January 23, 2014, the website went down with no explanation. It wasn’t built very secure, and after Jed McCaleb, the founder, had sold MtGox, the exchange got compromised, and it shut down without any notice. MtGox was the world’s largest Bitcoin exchange in 2014 and arguably also the first. Read more.

List of Failed Crypto Exchanges in 2013

In September 2012, BitFloor suffered a critical security lapse that resulted in a hack that saw 24,000 bitcoins stolen, a substantial sum at the time. This, coupled with the reported closure of BitFloor’s bank account in April 2013, forced the exchange to shut down completely. While initial attempts were made to reimburse users, these proved unsuccessful.

List of Failed Crypto Exchanges in 2012

Bitcoinica

Bitcoinica was an early player in the cryptocurrency exchange scene, launching in 2011. It offered leveraged trading with contracts for difference (CFDs) based on the Bitcoin-to-USD exchange rate. However, hackers compromised a team member’s email server and stole over 43,000 Bitcoins in 2012, leading to a suspension of operations. The company claimed sufficient reserves to cover the loss, which was not the case. The incident ultimately led to its demise.

Endless list

- At the Bitcoin.it Wiki you can find an even much longer list of exchanges and other cryptocurrency companies that stopped their business.

- You can also take a look at 6 Disastrous Cases of Cryptocurrency Exchanges Going Bankrupt (2019)

Have we missed out on something? Please leave us a message so we can update this list.