A P2P (peer-to-peer) Bitcoin exchange is a decentralized platform that allows you to buy and sell bitcoin directly with one another without the use of a third-party intermediary such as a bank or exchange. In this type of exchange, buyers and sellers can connect with each other directly, negotiate their own exchange rates, and complete transactions without the involvement of a central authority.

P2P Bitcoin exchanges are typically global in scope and allow you to exchange bitcoin for a variety of payment methods, including bank transfers, cash deposits, and online payment systems.

Benefits of P2P Exchanges

A P2P Bitcoin exchange provides several benefits to users. One of the primary advantages of using a P2P exchange is the decentralization of the platform, which allows for greater freedom and autonomy in trading. Additionally, most P2P exchanges offer a high degree of anonymity, as users do not need to provide personal information to trade. This can be particularly beneficial for those who value their privacy and security. P2P exchanges also typically have lower fees than centralized exchanges, which can save users money on transaction fees and potentially offer better exchange rates.

Furthermore, P2P exchanges are accessible to anyone with an internet connection, making it easier for people to buy and sell Bitcoin, particularly in countries where traditional banking systems are limited. P2P exchanges often facilitate faster transactions, as users can trade directly with each other without the need for intermediaries.

Finally, self custody is another important benefit of using a P2P Bitcoin exchange. When users hold their bitcoin on a centralized exchange, they are essentially trusting the exchange to hold and protect their funds. This can be risky, as exchanges can be vulnerable to hacks, thefts, or even insolvency. In contrast, P2P exchanges allow users to hold their bitcoin in their own wallets, giving them full control and ownership over their funds.

Find out more: What’s self custody?

How P2P Exchanges Work

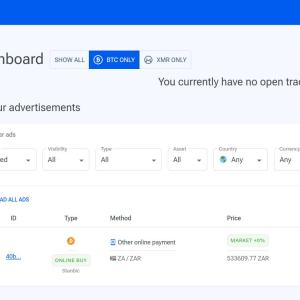

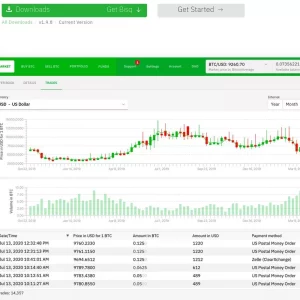

In a P2P exchange, you will typically create an account and list your buy or sell orders, along with the exchange rate and payment methods you are willing to accept. Other users can then browse your listings and contact you directly to negotiate the terms of the trade.

As a seller on a P2P exchange, you would finalize the trade once the terms have been agreed upon, and the buyer would then send payment directly to your account or wallet. You would then transfer the agreed-upon amount of bitcoin directly to the buyer’s wallet. In most cases, the P2P exchange would charge a small fee for facilitating the trade, but this fee is often lower than the fees charged by centralized exchanges.

Drawbacks

P2P Bitcoin exchanges have many benefits, such as greater privacy, decentralization, and user control over funds. However, there are also some drawbacks to consider when using these exchanges.

One of the main drawbacks of most P2P exchanges is lower liquidity compared to centralized exchanges. This can result in longer wait times for trades to be executed and lower trading volumes overall, which can impact the ability to buy or sell Bitcoin quickly.

Another potential drawback is the higher risk of fraud and scams on P2P exchanges. Because there is no centralized authority to regulate and monitor trades, users must rely on their own due diligence to verify the credibility of their trading partners. This can be challenging for new or inexperienced users, who may be more vulnerable to scams or phishing attacks.

Additionally, most P2P exchanges may have limited payment options, which can make it more difficult to buy or sell bitcoin. For example, some P2P exchanges may only support certain payment methods or currencies, which can limit the accessibility of the exchange for certain users.

Finally, P2P exchanges can be less user-friendly and difficult to use for beginners due to the lack of a standardized interface, technical knowledge requirements, and limited customer support.

Differences Between P2P and Centralized Exchange

The primary difference between a peer-to-peer bitcoin exchange and a centralized exchange is the way that trades are facilitated.

In a centralized exchange, trades are facilitated by a central authority or intermediary that matches buyers and sellers, executes trades, and holds users’ funds in custody. These exchanges typically have a more user-friendly interface and offer more advanced trading features, but users must trust the exchange to hold and protect their funds. Numerous exchanges have gone bankrupt or vanished with users’ funds. Here’s a list of collapsed exchanges.

In contrast, a P2P exchange facilitates trades directly between buyers and sellers without the need for a central authority or intermediary. This means that users can trade with each other directly, negotiate their own exchange rates, and hold their funds in their own wallets, giving them full control and ownership over their bitcoin. P2P exchanges are typically more decentralized, offer greater anonymity, and often have lower fees than centralized exchanges.

Another key difference is the level of security and reliability. Centralized exchanges can be vulnerable to hacks, thefts, or insolvency, which can result in the loss of users’ funds. P2P exchanges, on the other hand, allow users to hold their funds in their own wallets, reducing the risk of theft or loss.