Multisig (short for multi-signature) is a digital signature scheme in which multiple parties sign the same transaction or message. In other words, instead of just one private key, multiple private keys are required to authorize a transaction. Multisig operates similarly to joint bank accounts that require signatories to authorize transactions.

Multisig bitcoin wallet is commonly used for security purposes in bitcoin transactions involving multiple parties, such as a business requiring several executives to sign off on a large transaction. It can also be used to prevent a single point of failure, such as if one of the private keys is lost or compromised. A 2-of-3 multisig scheme, for example, would require the authorization of any two of three designated parties to sign off on a transaction. This means that even if one of the private keys is compromised, the transaction cannot be authorized unless the additional signatures are provided.

Imagine a two-person business partnership running an online store that accepts Bitcoin payments. They store their Bitcoin earnings in a multisig wallet to prevent any unauthorized or fraudulent activity by a single person. Let’s say they create a 2-of-3 multisig wallet. This requires two out of three private keys to authorize any Bitcoin transfers. Each partner can hold one key, and a trusted third-party like a lawyer or accountant can hold the third. This way, even if one partner’s device gets hacked or their key is lost, the funds remain secure as the other two keys are needed for any transactions. In case of disagreements between the partners, the neutral third party holding the key can mediate and decide on the appropriate action regarding the Bitcoin funds based on pre-determined agreements.

How Multisig Wallets Work

The functionality of a multisig wallet revolves around the concept of m-of-n signatures, where ‘m’ represents the minimum number of signatures required from a total of ‘n’ possible signatories to authorize a transaction. For instance, in a 2-of-3 multisig setup, any two out of three signatories must sign off on a transaction for it to be executed. This redundancy adds an extra layer of security, mitigating the risk of single-point failures or unauthorized access.

When a transaction is initiated from a multisig wallet, it is first broadcasted to the network, awaiting the requisite number of signatures. Once the predetermined threshold is met, the transaction is validated and executed, ensuring that funds can only be accessed with the explicit consent of multiple parties.

How to Create a Multisig Wallet

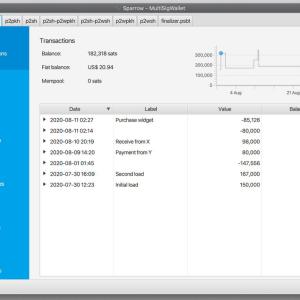

To create a multisig wallet, you need multiple participants who collaborate to generate a shared wallet requiring multiple signatures to authorize transactions. First, determine the number of participants involved, such as 2-of-3 configuration. In a 2-of-3 case, the wallet requires three signatures, but only two are needed to authorize a transaction. Next, choose a multisig wallet such as BlueWallet and Electrum. Each participant creates their own individual wallet and generates a public key within it. These public keys are then shared among participants. Using the chosen wallet, the shared public keys are combined to create the multisig address. Participants must securely store their private keys associated with their public keys. It’s essential to test the multisig wallet with a small transaction to ensure the required number of signatures are necessary to authorize it. Following the specific instructions provided by the wallet you have choosen will help create a secure and functional multisig wallet.

Benefits of Multisig Wallets

Multisig provides several benefits in bitcoin transactions: enhanced security by requiring more than one private key to authorize a transaction, reduced risk of fraud by requiring multiple parties to sign off on a transaction, increased accountability as multiple parties are responsible for a transaction, and more flexibility in arrangements, such as a company requiring multiple executives to sign off on a transaction or a family requiring multiple members to approve a transaction.

Here are some of the benefits of multisig wallets:

- Enhanced Security: By requiring more than one private key to authorize a transaction, multisig adds an extra layer of security. This makes it much more difficult for hackers to steal bitcoins or for individuals to lose bitcoins as a result of a single point of failure, such as the loss of a private key.

- Reduced Risk of Fraud: Multisig wallet helps reduce the risk of fraud in bitcoin transactions by requiring multiple parties to sign off on a transaction. This makes it harder for any single party to carry out fraudulent activities, as they would need to collude with others to do so.

- Increased Accountability: Multisig ensures that multiple parties are responsible for a transaction, which increases accountability. This can help to prevent errors or misconducts by any single party because they are less likely to act against the group’s interests.

- More Flexibility Multisig allows for more flexible arrangements in bitcoin transactions. For example, a company can require multiple executives to sign off on a transaction, while a family may use multisig to require multiple family members to approve a transaction.

In summary, multisig wallet requires more than one private key to authorize a bitcoin transaction. It increases security, control, flexibility, and accountability. Multisig is supported by various bitcoin wallets and platforms. When choosing a multisig solution, it’s important to consider your specific needs and requirements, and to do your own research to find the best option for you.

Disadvantages of Multisig Wallets

Despite the benefits offered by multisig wallets, there are a few drawbacks to consider:

- Complexity: Setting up and managing multisig wallets can be more complex compared to traditional single-key wallets, requiring careful coordination among signatories.

- Recovery Challenges: In the event of key loss or signatory disputes, recovering funds from a multisig wallet can pose logistical challenges.

- Delays: Reaching a consensus among all parties for approvals can introduce delays in transactions.

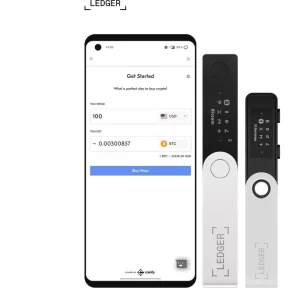

List of Multisig Hardware Wallets

Here are some of the best multisig hardware wallet:

- Blockstream Jade

- Foundation Passport Wallet

- Bitbox Wallet

- Coldcard Wallet

- Ledger Wallet

- Trezor Wallet

- KeepKey

Read also: Trezor Multisig Wallet

List of Multisig Mobile Wallets

Top multisig mobile wallets include the following:

List of Multisig Desktop Wallets

Popular multisig desktop wallets you can explore are the following:

Read also: Electrum Multisig Wallet

Should You Use a Multisig Wallet?

For individuals, businesses, or organizations handling significant amounts of Bitcoin, particularly those concerned with security or regulatory compliance, multisig wallets offer a compelling solution. Additionally, multisig features are ideal for Bitcoin inheritance plans and Bitcoin family offices, providing a secure and controlled way to manage Bitcoin wealth across generations.

Multisig wallets represent a significant advancement in Bitcoin security and minimizes the inherent risks of single-key wallets. While they may not be suitable for every user, their adoption continues to grow as the Bitcoin ecosystem matures and security remains a top priority. Whether opting for a hardware, desktop or mobile multisig solution, diligent research and consideration of your needs are crucial in benefiting from the full potential of multisig technology.

While multisig wallets offer top-notch security, they might not be the best fit for everyone. If you are a casual user with small amounts of Bitcoin, you may find the setup and management of multiple keys overly complex. Additionally, recovering funds can be tricky if a key is lost or disagreements arise between signatories (the people who approve transactions). Finally, getting everyone on board for approvals can lead to delays in spending your Bitcoin.