A no KYC exchange is a bitcoin exchange that does not impose Know Your Customer (KYC) rules. KYC is a regulatory process that requires you to give personal identity information when opening an account on an exchange, such as government-issued ID, phone number, a selfie, a video call and proof of residency.

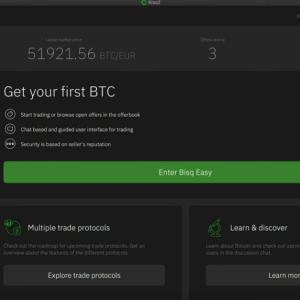

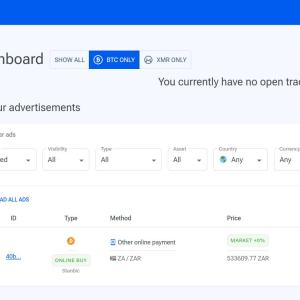

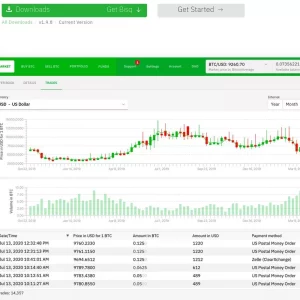

Non-KYC exchanges enable you to trade bitcoin without the need for the standard KYC verification process. The account creation process on these exchanges usually involves providing minimal information, such as an email address and password. Some non-KYC exchanges, like RoboSats, go even further by allowing you to trade without requiring an email, phone number, or username.

Benefits of Non KYC Exchange

The significance of a no KYC exchange lies in the privacy and anonymity it offers to its users. There are several compelling reasons why you should choose to buy or sell bitcoin on no KYC exchanges:

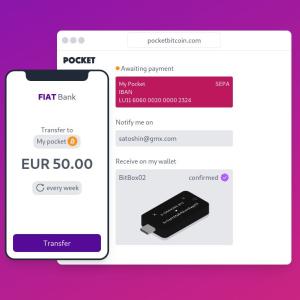

- Privacy protection. Non-KYC exchanges allow you to conduct bitcoin transactions without disclosing any personal information to the exchange. This protects your identity and helps maintain the anonymity of your transactions.

- Anti-Censorship and surveillance. Some non-KYC exchanges use Tor (The Onion Router) to enable you to bypass internet censorship and access bitcoin trading even in regions with restrictions or surveillance. Tor’s privacy features conceal IP addresses, making it difficult for third parties to trace your online activities.

- Accessibility. Non-KYC exchanges frequently provide a simpler onboarding process, making it easier for you if you do not have access to KYC-compliant documents or if you wish to remain anonymous while buying or selling bitcoin.

- Reduced Risk of Data Breaches. The risk of data breaches or hacks that could endanger your data is reduced because no KYC exchanges normally collect minimal personal information or no personal data at all.

- Flexibility. Non-KYC exchanges may provide more flexibility in terms of transaction limits, geographical restrictions, and trading options because they operate under less regulatory restraints than KYC-compliant exchanges.