Koinly Review: Bitcoin Tax Software

Koinly is a software designed to help you calculate and file taxes related to Bitcoin. With its automatic syncing feature, it can easily track your transactions and calculate your capital gains and losses by connecting to various exchanges and wallets.

Description

Koinly is bitcoin tax software that will assist you in calculating and filing your bitcoin taxes. It automatically syncs with several exchanges and wallets, making it simple to track transactions and calculate capital gains and losses. Koinly creates tax forms and reports that are in accordance with the tax laws of several nations, such as the United States, the United Kingdom, Australia, Canada, Germany, South Africa, and more.

Bitcoin tax refers to the taxes that you may owe on profits gained from purchasing, selling, or trading bitcoin. In numerous countries, bitcoin is regarded as property for tax purposes, and hence, any gains or losses are liable to capital gains taxes.

Reporting bitcoin gains or losses can be quite complex due to different tax treatments and regulations across different countries. It is crucial to comply with local tax laws and report gains or losses accurately. Platforms such as Koinly can be helpful in simplifying the process of calculating and reporting bitcoin gains or losses for tax purposes.

Koinly Features

Koinly provides numerous features to make calculating and reporting bitcoin gains and losses for tax reasons easier. Among its significant features are:

- Automatic data import: Koinly supports automatic data import from over 300 bitcoin exchanges and wallets, allowing users to easily import all their Bitcoin transaction data.

- Real-time transaction tracking: Koinly offers real-time tracking of transactions, allowing you to see your bitcoin balances and gains or losses in real-time.

- Accurate tax calculations: Koinly uses various methods to accurately calculate taxes, including FIFO, LIFO, and specific identification. It also takes into account factors such as fees, margin trading, and staking rewards.

- Tax reporting: Koinly offers several tax reports, including capital gains reports, income reports, and donation reports. You can also generate tax forms such as Form 8949, Schedule D, and others.

- Portfolio tracking: Koinly provides a portfolio tracker that allows you to track your bitcoin holdings and their performance over time.

- Audit support: Koinly offers audit support, which can be helpful in the event of a tax audit.

- Koinly API: The API can be used to build a crypto portfolio tracker that displays transaction history, market prices, and tax information. It can also be used to generate a crypto tax report that meets the requirements of a specific jurisdiction and integrate crypto tax reporting into a CRM system to make it easier for businesses to track their crypto transactions and taxes.

How Koinly Works

Koinly works by connecting to various bitcoin exchanges and wallets to automatically import transaction data. You can also manually import data or enter transactions manually. Koinly then calculates the capital gains or losses based on your transaction history and the cost basis of your bitcoin holdings.

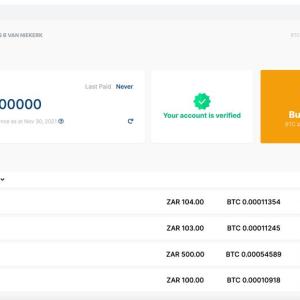

To get started with Koinly, use your Coinbase or Google account, or simply provide your name, email, and password. For convenience, there’s also Koinly app for your smartphone or tablet. The best part is that you don’t need to input any credit card details to try out Koinly. After creating your account, you can connect an unlimited number of wallets and exchanges. Once the accounts are connected, Koinly automatically imports the transaction data and starts calculating the gains and losses. You can even add your accountant to your Koinly account for collaboration. It’s worth noting that Koinly does not follow KYC (Know Your Customer) requirements, which means you can maintain your privacy while using the platform.

On your dashboard, you can then view your portfolio and transaction history, including realized and unrealized gains or losses. Koinly also generates tax reports that you can use to file taxes with the relevant tax authorities. The reports include a detailed breakdown of the gains and losses, as well as any other relevant information needed to file taxes.

How to Import Koinly CSV Files

Koinly offers flexibility for importing your cryptocurrency transactions, supporting over 300 exchanges, wallets, and services. Here’s how to tackle different scenarios:

- Supported Sources (Exchanges/Services):

- Auto-sync with API: For exchanges with Koinly integration, set up a read-only API connection during wallet creation. This keeps your data automatically updated.

- Import CSV/Excel: If your exchange allows exporting transaction history, download the file and import it directly into Koinly.

- Unsupported Sources:

- Import CSV (if available): Check if your exchange/wallet offers CSV exports. If the format works with Koinly, import it directly. You can request support for specific file formats if needed.

- Manual Entry or Custom CSV: If no CSV export exists, create a custom CSV file with your transaction details or manually add transactions through Koinly’s interface.

- Hardware/Software Wallets:

- Auto-sync with Blockchain: Create separate wallets in Koinly for each coin you hold. If Koinly supports auto-sync for that coin’s blockchain, enter the public address/key during wallet setup.

- Import CSV (if available): If your wallet allows exporting transaction history as a CSV/Excel file, import it into Koinly.

Is Koinly Accurate?

Determining Koinly’s accuracy is not a simple yes or no answer. Its accuracy depends on the accuracy of the data it imports from your exchanges and wallets. If your data is incomplete or inaccurate, Koinly’s calculations and reports will be affected. While it keeps up with regulations based on your specific location, some complexities or nuances might not be fully captured. Although it provides tools to categorize transactions and adjust data, user mistakes or miscategorization can impact accuracy.

According to Koinly, it has over 98% accuracy in matching transfers between wallets and they also ensure their FIFO methodology aligns with tax authorities’ guidelines. Many users report positive experiences with Koinly’s accuracy.

However, some users have encountered discrepancies, particularly with complex transactions. Common errors and inaccuracies on the Koinly platform include data inconsistency due to timestamps in different time zones, API integration discrepancies, unsupported file formats, missing or incorrect data, and API connection issues. These issues can lead to import problems and inaccurate calculations.

To mitigate them, you should use supported file formats like CSV or Excel, verify data accuracy before importing, and troubleshoot API connections or contact Koinly customer service if necessary. Alternatively, we would suggest you get a Bitcoin tax accountant to review and to fix the errors or do it manually. The latter can be extremely time consuming.

Koinly Fees

The Koinly free plan provides an overview of your taxes, but it does not generate any reports unless you choose to upgrade to a paid plan.

| Plan | Koinly Pricing (Annual Cost) | Wallets & Exchanges | Form 8494, Schedule D | International Tax Reports | Audit Reports | TurboTax and TaxAct Exports |

|---|---|---|---|---|---|---|

| Free | $0 | Unlimited | No | No | No | No |

| Newbie | $49 | Unlimited | Yes | Yes | Yes | Yes |

| HODLer | $99 | Unlimited | Yes | Yes | Yes | Yes |

| Trader | $179 | Unlimited | Yes | Yes | Yes | Yes |

| Pro | $279 | Unlimited | Yes | Yes | Yes | Yes |

Supported Exchanges and Wallets

Koinly supports over 300 bitcoin exchanges and bitcoin wallets. Here are some of the popular wallets and exchanges that Koinly supports:

Bitcoin Exchanges

Bitcoin Wallets

Supported Countries

Koinly supports users from around the world, but tax reporting features are available only for certain countries. They include the following countries:

- United States

- Canada

- United Kingdom

- Australia

- Germany

- France

- Spain

- Italy

- Netherlands

- Sweden

- Denmark

- Norway

- Finland

- Switzerland

- New Zealand

- Malta

- South Korea

- Singapore

- South Africa

Is Koinly Legit, Safe, and Trustworthy?

Koinly prioritizes your privacy that’s why it doesn’t share your data with the government or any third parties, and only requires an email address, allowing you to remain anonymous throughout the process.

It implements a variety of safeguards to protect user data. To begin, Koinly protects your data with bank-grade security methods such as encryption, firewalls, and two-factor authentication. Furthermore, Koinly uses API keys to connect to exchanges and wallets securely and does not store user API keys on its servers.

Koinly also has rigorous data privacy standards in place and does not disclose or sell your data to third parties. The platform is GDPR-compliant, ensuring that your data is collected and processed in a lawful, transparent, and secure manner. Finally, Koinly allows you to export your transaction data at any time, giving you complete control over your data.

Drawbacks

While Koinly is a popular and highly-rated platform for calculating bitcoin taxes, there are some potential disadvantages to consider:

- Cost: While Koinly offers a free plan, the more advanced features are only available on paid plans, and the cost can add up quickly if you have many transactions to report.

- Complexity: Koinly can be quite complex to set up and use, especially if you have multiple wallets and exchanges to connect. The platform requires you to enter your API keys or upload CSV files to import your transaction history, which can be time-consuming and may require some technical know-how.

- Accuracy: While Koinly is generally accurate in its calculations, there is always a risk of error or miscalculation, especially if you manually enter transaction data or import incomplete data. It’s important to review your tax reports carefully and consult with a tax professional if you have any doubts about the accuracy of your calculations.

- Limited tax reporting for some countries: While Koinly supports users from around the world, tax reporting features are available only for certain countries. If your country is not on the list of supported countries, you may need to use the generic tax report or consult with a tax professional for specific advice related to your situation.

Handling Bitcoin Tax with Koinly

The tax treatment of bitcoin varies depending on several factors, such as the duration of the investment, the amount of gains or losses, and the investor’s location. In the US, for instance, long-term capital gains tax rates (gains on investments held for over a year) range from 0% to 20% based on the investor’s income level.

Accurately tracking transactions and understanding their tax implications can be a complex and time-consuming task. Koinly is one tool that aims to simplify this process by offering automated transaction import, tax calculations, tax audit, and report generation. Moreover, it integrates with various Bitcoin exchanges and wallets, automatically fetching transaction data and market prices. This eliminates the need for manual data entry, reducing the risk of errors and saving time.

While it offers its services to users globally, specialized Koinly tax reporting features are restricted to specific countries (see the list above).

Koinly Alternatives

There are several alternatives to Koinly for calculating bitcoin taxes. Some popular alternatives include:

- CoinTracking: a platform similar to Koinly that allows you to import transaction data from multiple exchanges and wallets, and calculates gains or losses for tax purposes. It also offers features such as portfolio tracking, tax reports, and trading analysis.

- ZenLedger: it helps you calculate taxes on bitcoin gains and offers features such as transaction reconciliation, capital gains reports, and audit support.

- CryptoTrader.Tax: a bitcoin tax platform that offers features such as cost basis tracking, tax optimization, and automated tax form generation.

- Bitcoin.Tax: it is a platform that enables you to calculate bitcoin taxes with features such as transaction tracking, capital gains reports, and tax form generation.

Koinly FAQs

What's Koinly?

Koinly is a tax software designed to help you calculate and file taxes related to Bitcoin. It easily tracks your transactions and calculate your capital gains and losses by connecting to various exchanges and wallets.

Is Koinly free?

Koinly offers both free and paid plans, so it depends on your needs and usage.

Does Koinly report to IRS?

Koinly is a software tool designed to help you track your bitcoin transactions and generate tax reports, but it doesn't automatically share any information with the IRS. The responsibility to report your bitcoin gains and losses lies with you, the individual taxpayer.

Additional information

| Bitcoin Only | |

|---|---|

| Mobile App | Yes |

| Operating System (OS) | |

| API | Yes |

| Supported Countries | Worldwide |

| Year Launched | 2018 |

| Headquarters | London |

Reviews

There are no reviews yet.