Juno: Convert Paycheck Into Bitcoin

Receive a portion or the entirety of your paycheck into bitcoin and autoinvest using Dollar Cost Averaging (DCA) method in the United States, using Juno banking platform.

Description

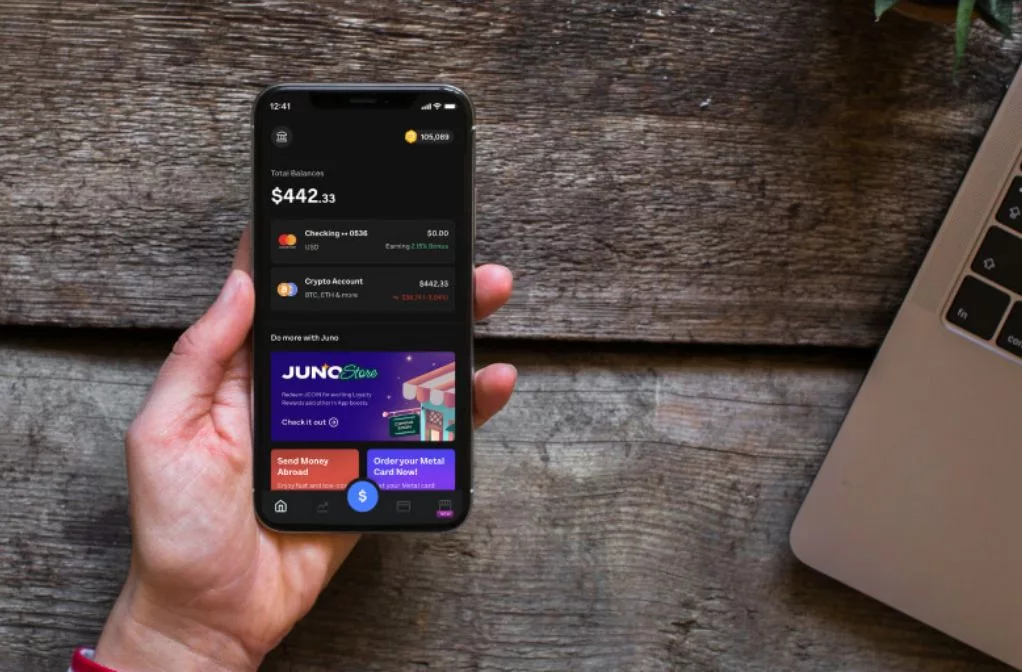

Juno (formerly OnJuno) is a fintech in the United States that offers you FDIC Insured checking accounts to allow you to receive your paycheck in bitcoin or to autoinvest using Dollar Cost Averaging (DCA) method. In addition, the fintech offers a bitcoin debit card.

Your employer doesn’t have to be on board to pay you in bitcoin because Juno converts a portion or the entirety of your paycheck into bitcoin. You can also buy and sell bitcoin on Juno. One of the primary advantages of being paid with bitcoin is that you avoid the middleman and receive your payment instantly. You also avoid chargebacks and other overhead fees.

Although Juno is currently operational only for users in the US, it is going global very soon. You can sign up for early access.

How Juno works

To open an account, go to the Juno website. During your application, you need to provide the following information.

- Name

- Phone number

- Home address

- Number of Social Security

- Identity-verification documents (passport, driver license, etc.)

Once your information has been successfully verified, you will have access to your Juno account. You need to have a non-custodial wallet and integrate your Direct Deposit in Juno. If your workplace does not have Instant Switch, you can set up Direct Deposit by entering your account and routing data or by filling out the DD form.

Furthermore, Juno allows you to buy and sell bitcoin using cash from your bank account. You can withdraw bitcoin from Juno in seconds to your external wallet. You can also withdraw funds from ATMs worldwide or transfer funds from Juno to another bank account.

Juno doesn’t charge any fees for depositing or withdrawing bitcoin to and from external wallets. You will still need to pay network fees.

Juno Checking Account

Juno offers FDIC-insured checking accounts. Juno allows users to receive their paycheck in bitcoin or automatically invest using the Dollar Cost Averaging (DCA) method.

Juno Debit Card

In addition to its checking accounts, Juno offers a bitcoin debit card for seamless bitcoin spending. With this card, you can make purchases using your bitcoin or fiat funds, making it convenient for everyday use.

Juno Interest Rates

Juno checking accounts feature high-interest rates, helping users earn more on their deposits. With zero monthly fees and competitive interest, Juno provides an attractive option for users looking to grow their savings.

Juno Autoinvest

Juno supports dollar-cost averaging (DCA). Dollar-cost averaging is the practice of investing the same amount of money, bitcoin in this case, at regular intervals over a specified time period, regardless of price. With Juno, you may easily direct a portion of your earnings into Bitcoin and adopt a DCA plan in a scheduled interval.

Is it legal to receive your salary in bitcoin?

Juno gets the employer’s paycheck in fiat in accordance with the Fair Labor Standards Act, after which it automatically transforms a portion of the income into bitcoin. With Juno, your salary will be subject to the same tax rules as it is now. This is because your employer is already paying you in fiat currency and does not need to change their present payroll systems in order for you to receive a bitcoin paycheck.

Is Juno Legit

Juno is a legitimate and safe financial services company. Juno is partnered with Evolve Bank & Trust, which is a FDIC-insured bank. This means that your deposits are protected up to $250,000 in the event that Juno were to fail.

Juno has a good reputation online. It has a 3.9-star rating on Trustpilot, based on over 450 reviews. The reviews are generally positive, with people praising the company’s customer service, high interest rates, and easy-to-use app. However, there are a few negative reviews, which mention issues with the app crashing, frozen accounts, long wait times for customer service, and difficulty linking external accounts.

Is Juno a Good Bank for You?

Juno offers a unique solution for those looking to integrate Bitcoin into their financial lives. Its ability to convert paychecks into Bitcoin, support Dollar Cost Averaging, and provide a Bitcoin debit card makes it a convenient option for crypto enthusiasts. The platform’s FDIC-insured checking accounts offer peace of mind for your USD holdings, but it’s essential to remember that digital assets like Bitcoin are not insured.

Unlike exchanges such as Coinbase and Kraken, which impose a holding period of 7–10 days before allowing you to withdraw Bitcoin to your wallet or cash out, Juno offers a faster access to funds. However, it’s important to note that Juno has its own set of challenges. Users have reported app crashes, frozen accounts, stolen funds, long wait times for customer service, and difficulties in linking external accounts.

Another critical point is the distinction between USD and digital assets within your Juno account. While USD held in your Cash Account through Juno’s partner bank, Evolve Bank & Trust (Member FDIC), is insured up to $250,000, digital assets like Bitcoin are not covered by FDIC insurance or any other government-backed or third-party insurance. This means that while your USD holdings are protected in the event of bank failure, your Bitcoin holdings are not.

More information

Additional information

| Bitcoin Only | |

|---|---|

| Receive Paycheck in Bitcoin | Yes |

| KYC | |

| Built-in Exchange | |

| Bitcoin Investment Plan | |

| Bitcoin Debit Card | Yes |

| Mobile App | Yes |

| Operating System (OS) | |

| Year Launched | 2017 |

Reviews

There are no reviews yet.