Fold App: Bitcoin Rewards App

Fold is a mobile shopping card that allows you to earn bitcoin rewards in the US from your purchases at major retailers such as Amazon, Starbucks, Whole Foods, and Uber, Best Buy, Target, Dunkin’ Donuts, and Chipotle.

Description

Fold is a Bitcoin rewards app offering Bitcoin cashback, a Bitcoin debit card, and merchant rewards. The app features integrated insured Bitcoin custody and no-fee trading. Supported U.S. retailers include Amazon, Starbucks, Best Buy, Whole Foods, Target, Dunkin’ Donuts, and Chipotle, all accessible through the Fold debit card. Additionally, Fold allows users to buy Bitcoin in the U.S.

How Fold App Works

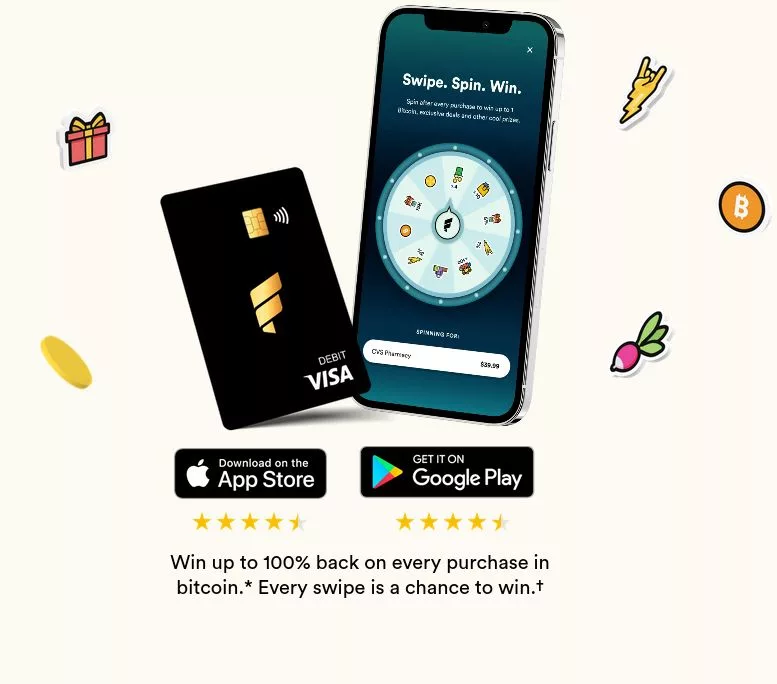

There are two versions of the Fold card, Spin and Spin+. If you swipe the Fold debit card anywhere Visa is accepted, you earn up to 1.5% back in Bitcoin on your purchases. Plus, each transaction comes with a chance to spin a virtual prize wheel for an even bigger Bitcoin reward, potentially up to 25% back. If you buy gift cards from various retailers like Amazon directly through the Fold app, you’ll not only get the gift card, but Fold will also reward you with a percentage of the purchase back in Bitcoin. The exact percentage varies depending on the retailer. There are also bitcoin rewards on bill pay, including mortgage, rent, and credit card bills.

Furthermore, you have the option to link your Fold card with PayPal’s Bill Pay service to cover expenses such as mortgages, insurance, rent, loans, and more. This is especially beneficial for transactions where credit cards aren’t accepted or where the transaction fee surpasses the cashback earned from using a credit card. It’s worth noting that certain credit/debit card companies explicitly state in their terms and conditions that cashback might not be applicable for loan payments or third-party accounts such as PayPal.

The Fold Bitcoin app also gamifies Bitcoin earning with a daily spin wheel. Just like the spin after each purchase, this free daily spin gives you a chance to win Bitcoin. There are even streaks and boosts you can unlock to maximize your rewards. Finally, Fold has a built-in exchange so you can easily buy and sell Bitcoin directly within the app, if you choose to.

The Fold app is available for Android and iOS devices. To use the Fold Bitcoin app, you must first create an account and link your credit or debit card. You can then browse a list of participating retailers, including smaller, local businesses, and make purchases using your linked card to earn rewards in the form of bitcoin.

The rewards can be redeemed through the app or transferred to a personal bitcoin wallet. Fold does not charge you any fee to withdraw your bitcoin from Fold to your personal bitcoin wallet. Note that Fold supports the Lightning Network for your transactions on the app.

How to Buy Bitcoin on Fold App

You can buy Bitcoin on the Fold app using three main ways:

- Spot Buys: This is the most straightforward option. You simply choose the amount of Bitcoin you want to purchase and Fold will execute the transaction at the current market price. There’s a 1.5% fee associated with spot buys for standard Fold users (free for Spin+ subscribers).

- Auto-Stack (DCA): This feature allows you to set up automatic, recurring Bitcoin purchases. You can choose a specific amount or a percentage of your paycheck to be invested in Bitcoin at regular intervals (daily, weekly, etc.). Auto-Stack purchases come with a 1% fee for Spin users (free for Spin+). This strategy, known as Dollar-Cost Averaging (DCA), helps you accumulate Bitcoin over time regardless of market fluctuations.

- Round-Ups: Fold can round up your everyday purchases to the nearest dollar and automatically invest the difference in Bitcoin. This is a convenient way to passively accumulate Bitcoin with small, regular purchases. There are no additional fees for using Round-Ups.

Fold App Fees

Here’s a general overview of fees to be expected:

| Feature | Spin | Spin+ |

|---|---|---|

| Monthly fee | free | $10 |

| Purchase Bitcoin (Auto-Stack) | 1% fee | No fees |

| Purchase Bitcoin (Spot buy) | 1.5% fee | No fees |

| Instant transfers | 1.5% fee | 1.5% fee |

| Fold card ATM fees | No fees | No fees |

| ATM operator fees | May be charged a fee by the ATM operator | May be charged a fee by the ATM operator |

| Card inactivity fee (failing to initiate a transaction for 12 consecutive months) | $5 per month | No fees |

| Replacement Card Fee | $5 | No fees |

Is Fold App Safe?

The Fold Card operates as a debit card linked to a bank account, allowing you to deposit funds for transactions. Managed through a fintech company’s app, Fold provides access to your card and account management. In partnership with Sutton Bank, a traditional bank, Fold offers FDIC insurance coverage for up to $250,000 for your USD funds held on the Fold Card. However, it’s essential to understand that Bitcoin rewards earned through the platform are not FDIC insured.

To safeguard Bitcoin holdings, Fold employs a Qualified Custodian, Fortress Trust Company, in conjunction with Bitgo, which offers full reserves and insurance. While Fold operates as a custodial service, it strongly advocates for self-custody, especially as wealth accumulation grows.

Should You Use Fold Card and App?

In conclusion, the Fold Bitcoin app and Fold debit card offer innovative ways to earn Bitcoin rewards on everyday purchases. While the Fold card provides Bitcoin back on purchases, it’s important to note that the rates obtained may not always match the benefits one could receive from conventional credit card cashback rates ranging from 2-5%. Nonetheless, with its gamified approach to earning Bitcoin, gift card purchases, Lightning Network support, and integrated exchange functionalities, the Fold rewards presents a great avenue for those interested in exploring Bitcoin rewards within their daily spending habits.

Note that currently, the Fold app and services are not allowed in any countries outside the US.

Additional information

| Bitcoin Only | |

|---|---|

| Lightning Network | |

| Mobile App | Yes |

| Operating System (OS) | |

| Built-in Exchange | |

| Bitcoin Investment Plan | |

| KYC | |

| Year Launched | 2019 |

| Made in | USA |

Reviews

There are no reviews yet.