Stable Channels: Bitcoin-Backed USD on Lightning

Stable Channels is an open-source project that integrates Bitcoin-backed dollar balances with the Lightning Network, offering exposure to both USD stability and Bitcoin’s growth potential.

Description

Stable Channels is an open-source project that brings Bitcoin-backed dollar balances to the Lightning Network, allowing you to gain exposure to both USD stability and Bitcoin’s growth potential. It does so by matching BTC shorts and longs over Lightning channels, eliminating the need for fiat, banks, tokens, or third-party custodians. This system provides an innovative way to use Bitcoin for stable payments and derivatives trading while maintaining self-custody and financial privacy.

Key Benefits

Stable Channels offers several unique advantages over traditional stablecoin models:

- Self-Custodial – You retain control over your private keys and funds without relying on intermediaries.

- No Fiat, No Banks, No Tokens – Unlike stablecoins pegged to fiat reserves held in banks, Stable Channels operates purely on Bitcoin and Lightning.

- Decentralized and Privacy-Focused – No KYC, no custodial risk, and no dependency on external financial institutions.

- Tax Advantages – You remain within the Bitcoin ecosystem without triggering taxable events related to traditional stablecoin transactions.

- Flexibility – You can either stabilize your Bitcoin holdings in dollar terms or take leveraged long positions within a bilateral agreement.

How Stable Channels Works

Stable Channels operate with two types of users:

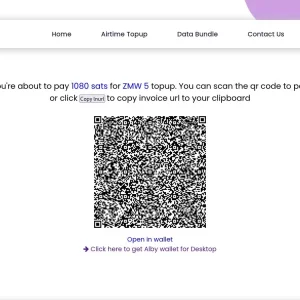

- Stable Receivers – These users seek USD stability by pegging their BTC to a fixed value, such as $100.

- Stable Providers – These users want leveraged Bitcoin exposure and take on 2x volatility.

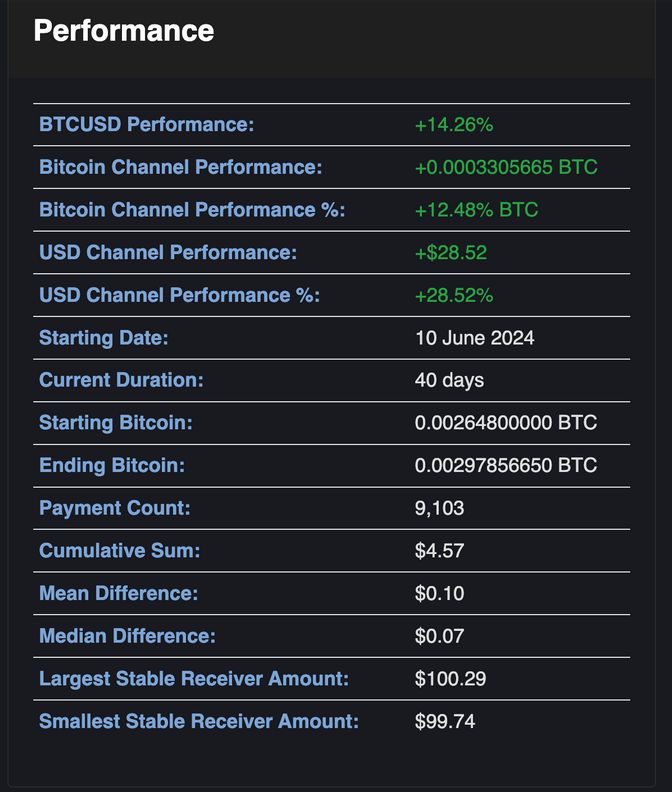

The platform allows them to trade over the Lightning Network in a way that minimizes trust. As Bitcoin’s price changes, the system adjusts both users’ balances to ensure they stay aligned with their goals. Lightning settlements happen instantly, keeping everything balanced and fair in real time.

Here’s an example of how it works:

- If you’re a Stable Receiver, you could peg 0.00131 BTC to a stable USD value of $100 (assuming Bitcoin’s price is $76,531). As Bitcoin’s price fluctuates, the system adjusts your balance to maintain that $100 value, regardless of market changes. The Stable Provider takes on the risk of Bitcoin’s price changes for the potential to gain leveraged exposure. On the other hand, a Stable Provider would take on the risk of Bitcoin’s price fluctuations, aiming to profit from its volatility.

- Initial Pegging: When you peg 0.00131 BTC to $100 (with Bitcoin priced at $76,531), the system records this value as your starting point.

- Price Fluctuations: As Bitcoin’s price rises or falls, the system tracks these changes in real time.

- Balance Adjustment: If Bitcoin’s price increases (e.g., it rises to $80,000), the value of your 0.00131 BTC will now exceed $100. In this case, the system will adjust your balance by reducing the amount of BTC you hold, keeping the equivalent value in USD stable at $100.

- Vice Versa: If Bitcoin’s price drops (e.g., it falls to $70,000), the value of your 0.00131 BTC would fall below $100. The system will then increase your BTC balance to maintain the $100 value.

Fees and Price Feeds

Stable Channels uses a median price from five sources (BitStamp, CoinGecko, Coindesk, Coinbase, and Blockchain) to ensure fair valuations. This multi-source approach minimizes oracle risk and prevents price manipulation. The platform’s continuous settlement model reduces counterparty risk since either party can close the agreement at any time.

Is Stable Channels Safe and Legit?

Stable Channels is designed for resilience and financial sovereignty. Each participant remains self-custodial, ensuring that funds are not at risk from third-party failures. However, this structure also comes with trade-offs:

- You must run a Lightning node and manage hot private keys.

- Channels must remain online for continued stability.

- If Bitcoin’s price drops significantly (over 50%), the channel may need additional liquidity to maintain peg stability.

- Counterparties can leave at any time, requiring proactive risk management.

Despite these challenges, the system’s at-will agreements and continuous rebalancing provide strong security assurances for participants.

Should You Use Stable Channels?

Stable Channels represents an innovative step forward for Bitcoin-native financial instruments. It is particularly suited for technical Lightning node operators, businesses leveraging Lightning for payments, and wallet developers seeking decentralized stability solutions.

While it requires technical proficiency to operate, this option is ideal if you want to access US dollars or Bitcoin without relying on stablecoins pegged to fiat reserves held in banks or triggering taxable events. Its decentralized nature and privacy-preserving features, such as no KYC, make it particularly appealing especially to Bitcoin maximalists.

However, keep in mind that you must run a Lightning node and manage hot private keys. Channels also need to remain online for continued stability. Additionally, if Bitcoin’s price drops significantly (over 50%), your channels may require extra liquidity to maintain peg stability.

Additional information

| Mobile App | No |

|---|---|

| Lightning Network | |

| Source Code | |

| KYC | |

| Year Launched | 2023 |

Reviews

There are no reviews yet.