Firefish Review 2024: P2P Bitcoin Lending Platform

Firefish Bitcoin is a peer-to-peer Bitcoin lending platform where users can act as either borrowers or investors.

Description

Firefish is a peer-to-peer Bitcoin lending platform where users can act as either borrowers or investors. Borrowers can receive cash loans by placing Bitcoin as collateral. This means they use their Bitcoin holdings to secure a loan without selling them. Investors can earn interest in providing funds to these borrowers.

How Does Firefish Work?

Get a 30% discount on the origination fee

To borrow or invest with Firefish, they require ID verification from EU, UK, or Swiss issued IDs or passports, a bank account within those regions, and a registered mobile phone camera for security.

Firefish uses a multi-signature escrow address to hold the borrower’s Bitcoin securely. This ensures that no one can access the Bitcoin except for the borrower upon full repayment or in the case of a default.

The Firefish loan requirements involves several stages, including requesting a loan, matching with an investor, locking Bitcoin in a multisig escrow address, receiving funds in your bank account, and retaining control of Bitcoin through an on-chain multi-signature contract. The borrower repays the loan with interest within the agreed term. You can choose a loan term that suits your needs, with options ranging from 3 to 18 months.

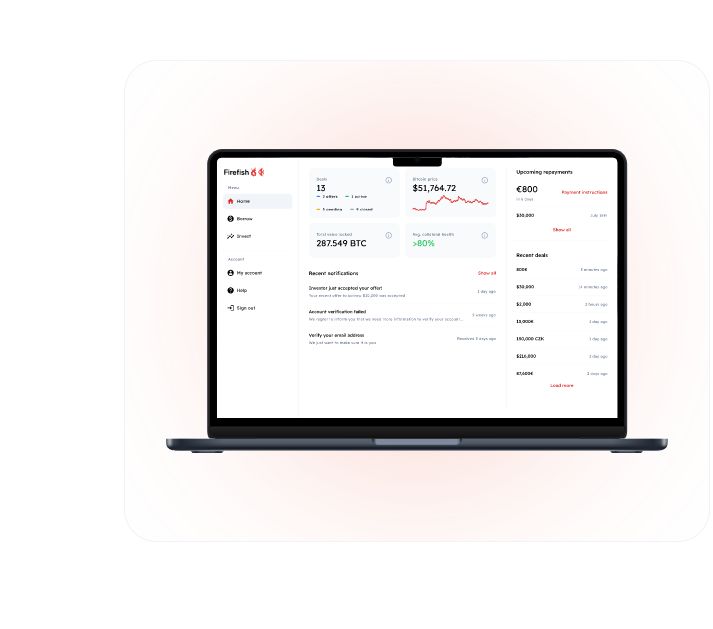

For investors, you earn interest in providing funds for borrowers’ loans. There are two primary methods of engaging with the platform for investors. The first is through the Loan Marketplace, which showcases all available deals that have yet to be matched with a specific investor. The second method is the Watchdog feature, which functions as an email notification service. Through Watchdog, investors can tailor their preferences based on currencies, minimum and maximum loan amounts, interest rates, and loan periods. When an investor creates a Watchdog and a borrower submits a loan request that matches the specified preferences, an email notification is promptly sent to the investor.

Firefish loan interest rates, ranging from 7% to 10%, are market-driven, determined by supply and demand dynamics within the platform’s user base. Therefore, borrowers and investors participate in an open marketplace, with interest rates reflecting prevailing market conditions.

Firefish Prime is a product offering lending solutions for institutions, businesses, and high net worth individuals with loan amounts starting from $100,000 and terms up to 5 years.

Firefish requires a collateralization ratio of 2x, meaning the value of your Bitcoin collateral must be double the amount you borrow plus any interest accrued. For instance, borrowing €1,000 for a year at 6% interest (total due €1,060) would require locking €2,120 worth of Bitcoin collateral. Keep in mind that on top of this, there are additional fees to consider, including current blockchain fees and a 1.50% Firefish service fee deducted when transferring Bitcoin. These fees will slightly increase the total amount of Bitcoin collateral you need to provide.

Get a 30% discount on the origination fee

Firefish Fees

Firefish charges borrowers an origination fee of 1.5% of the loan amount. You’ll see this fee clearly labeled “Origination Fee” when you submit your loan request. The fee is automatically deducted from the Bitcoin collateral you provide as security for the loan during the collateral locking process. In other words, you won’t receive the full amount of your loan – the 1.5% origination fee will be subtracted from the final loan amount.

Firefish Supported Countries

Firefish is currently focused on serving the European Union, Switzerland, and the United Kingdom. However, they have their sights set on a global audience. They recognize the potential benefits their platform offers to bitcoiners worldwide and are actively exploring ways to expand into new markets.

Is Firefish Safe and Legit?

Firefish prioritizes security and legitimacy to safeguard users throughout the lending process. They minimize risk through Loan-to-Value Ratio (LTV) Limit, which means the maximum loan amount is capped at 50% of the Bitcoin collateral’s value, reducing the risk of defaults. Their multi-signature escrow means your Bitcoin remains secure in a multi-signature address, requiring multiple approvals for access.

If a borrower defaults, Firefish offers two liquidation options: Self-Liquidation where you receive the owed amount, interest, and a premium directly in Bitcoin and Assisted Liquidation in which Firefish sells the collateral and returns your investment in fiat currency. Furthermore, Firefish implements Two-Factor Authentication (2FA) for enhanced account security.

Firefish Alternatives

If Firefish does not meet your needs, consider exploring other platforms like the following:

Is Firefish a Good Bitcoin Lending Platform?

When evaluating Firefish as a Bitcoin lending platform, there are several factors to take into account. One notable advantage is its unique approach to borrowing and lending with Bitcoin, offering you a secure platform through an escrow system. Firefish stands out as a noncustodial peer-to-peer lending platform, which means it doesn’t hold your funds but rather facilitates direct transactions between borrowers and lenders. Additionally, it operates in a decentralized manner, meaning you have greater control over your assets and reducing reliance on intermediaries.

Transparency is another positive aspect, as Firefish BTC operates within an open marketplace with clearly defined loan terms. Additionally, the platform provides flexibility, giving both borrowers and investors various options to choose from. The marketplace emphasizes its Bitcoin-native nature, powered directly by the Bitcoin network, with no reliance on sidechains or smart contract platforms.

However, it’s essential to consider some drawbacks as well. At the moment, the platform is only available in EU, UK, and Swiss. Firefish’s Know Your Customer (KYC) procedures could potentially be a drawback to some user. Luckily, Firefish is considering using stablecoins to provide more privacy and reduce KYC burdens. As a relatively new platform, Firefish may not offer the same level of user experience and reliability as more established Bitcoin lending platforms.

Additional information

| Bitcoin Only | |

|---|---|

| 2FA | |

| Type of Lending Platform | |

| KYC | |

| Supported Countries | EU, Switzerland, UK |

| Year Launched | 2022 |

| Made in | Czech Republic |

Reviews

There are no reviews yet.